“Drill Baby Drill!” The signature energy battle cry of Donald Trump has returned to center stage as he returns to the White House. His vision for American energy dominance is taking shape with the nomination of Chris Wright, a vocal advocate for fossil fuels, as his choice for Energy Secretary.

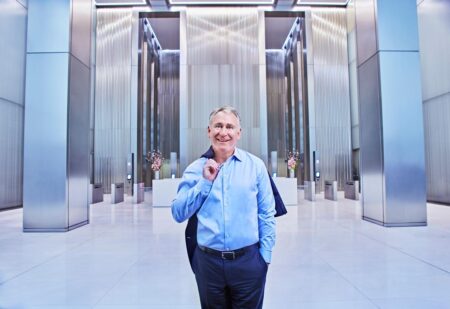

Wright, 60, made his position clear during his Senate confirmation hearing last week: “Previous administrations have viewed energy as a liability instead of the immense national asset that it is.” His appointment signals a dramatic shift from current energy policies, with a laser focus on expanding domestic production across multiple sectors.

The Liberty Energy CEO, who is expected to win Senate confirmation, brings a unique perspective to the role. “To compete globally, we must expand energy production, including commercial nuclear and liquefied natural gas, and cut the cost of energy for Americans,” Wright declared during his hearing. His stance represents a stark contrast to the Biden administration’s pause on LNG export approvals and restrictions on federal land drilling.

The focus on expanded energy production extends beyond the Department of Energy. Interior Secretary nominee Doug Burgum reinforced this agenda during his confirmation hearing, pledging to vigorously pursue maximizing energy production from U.S. public lands and waters as a national security imperative. His comments signal a dramatic reversal from the Biden administration’s efforts to limit oil and gas drilling through reduced federal lease auctions and offshore development restrictions aimed at addressing climate change.

Wright’s vision extends beyond traditional energy sources. As an MIT-trained engineer who studied fusion energy, he supports developing small nuclear power reactors and geothermal energy, while expressing skepticism about the sufficiency of solar and wind power. “The solution to climate change is to evolve our energy system,” Wright told the Senate energy committee, adding, “Do I wish we could make faster progress, absolutely.” This pragmatic approach to energy transition aligns with Trump’s broader energy independence agenda.

Investment Opportunity: SLB’s Strategic Position

For investors looking to capitalize on this shift in energy policy, SLB (formerly Schlumberger) presents a compelling opportunity. The company’s strong market position was recently highlighted by a 6% surge in its stock price on Friday’s trading following better-than-expected Q4 adjusted earnings, driven by robust demand for its drilling equipment and technology. The company’s confidence in its future is demonstrated by its dividend increase and announcement of a $2.3 billion stock buyback program.

As the largest service provider to the oil and gas industry, SLB’s global presence across more than 100 countries positions it uniquely to benefit from expanded domestic energy production. The company’s Q4 performance, particularly strong gains in its digital and integration business, showcases its technological leadership and operational efficiency.

While the energy sector’s cyclical nature presents inherent challenges, SLB’s valuation suggest significant upside potential. Trading at less than 11 times earnings with a 3% dividend yield, the stock appears undervalued. SLB’s aggressive share buyback program and strong financials, combined with its AI integration and low debt levels, position it well for 2025’s expected energy expansion.

The company’s technological leadership and global scale make it an attractive vehicle for investors looking to capitalize on potential U.S. energy policy shifts. As America moves toward more aggressive domestic production, SLB’s comprehensive capabilities position it to play a crucial role in this transformation.

Disclosure: The author does or has held positions in the stocks mentioned. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

Read the full article here