Bank of America’s potential net interest income trough opens an opportunity for top-line growth.

By Daniel Urbina

Summary

- Despite Warren Buffett selling shares, Bank of America’s net interest income recovery and fair valuation make it a strong investment opportunity.

- Lower rates and a steepened yield curve position Bank of America for growth in net interest income that has been lagging.

- Although the bank has gained over 60% over the last year, the valuation still looks attractive.

Over the recent months, Bank of America (BAC, Financial) has been in the headlines as legendary investor Warren Buffett sold many of his shares in the North Carolinian bank. With this, Buffett owns less than 10% of the company, allowing him to refrain from reporting his stock transactions from now on.

Should retail investors blindly follow Buffett’s actions and avoid initiating a position or trimming positions in Bank of America’s stock? The answer is no.

First, Buffett has many potential reasons to sell the stock, and multiple bearish transactions do not constitute a pessimistic outlook on the stock alone. For example, the sale could be attributed to a portfolio rebalancing. Second, when observing Berkshire’s positions, Bank of America represents the second largest holding, and one can’t be bearish on a company while holding more than $40 billion in it.

Setting Buffett aside, let me explain why Bank of America’s current landscape represents an opportunity for investors to be bullish on the stock.

The primary source of income for money center banks is usually net interest income from consumer banking, which is what banks earn from lending products after paying depositors and wholesale funders.

In Q1 of 2022, a hawkish Fed allowed banks to increase their net interest income as loan demand was still high, and the yields earned were generally higher. Nonetheless, this only lasted for part of the rate hike period as higher interest rates began to make loan originations less appealing. In addition, depositors found money market yields attractive and shifted sight deposits towards term deposits, which are a more expensive funding source for banks.

This condition ultimately translated into lower gains from net interest income, and Bank of America wasn’t the exception. As illustrated above, the net interest income from the Bank of America Consumer Banking segment began to fall sequentially from Q1 of 2023. Yet, after the Fed’s first rate cut, the most recent quarter finally saw a net interest income gain after multiple consecutive drops.

With a dovish monetary policy, Bank of America is in an excellent spot to call Q2 of 2024 the net interest income trough and substantially gain from these tailwinds in 2025. Let me explain why.

- First, lower rates induce customers to originate loans as borrowing becomes cheaper.

- Second, funding pressure eases as sight deposits are less likely to move toward higher-yielding deposits, and maturing CDs reinvest at lower rates.

In addition, since the FED’s first rate cut in September, the yield curve has steepened as longer-term yields have gained roughly 105 bps. This bull steepener is the best macro scenario for a bank as there are more opportunities for maturity transformation as banks can borrow cheaper on short maturities and lend at higher rates in longer maturities.

It is worth mentioning that management had been expecting a net interest income recovery in Q3 of 2024 for over a year. Surprisingly, they hit the estimate at the exact time they expected it. Regarding that, Bank of America’s CEO Brian Moynihan had this to say in the most recent earnings call.

“Four quarters ago, we called that a bottom would occur in our net interest income in the second quarter of 2024. Even with a rate environment that has bounced around quite a bit since we said that we got it right. As we expected then, NII indeed troughed in the quarter two. NII grew 2% this quarter and Alastair will note later, we expect NII to grow again in quarter four, even as the market expects two more rate cuts in quarter four.” Brian Moynihan, Bank of America CEO.

Furthermore, during the conference call, management remained optimistic about the bank’s net interest income trajectory and called for a sequential rise once again in Q4 of 2024.

“With regard to a forward view of NII, there are obviously several variables at play in the Q4, and we still expect Q4 NII to grow” Alastair Borthwick, CFO.

BAC: Strength in Non-Interest Revenue

Money center banks such as Bank of America are heavily diversified. Although net interest income tends to be their main source of revenue, other non-interest income, such as investment banking, trading, wealth and asset management, are also factors for top-line growth. The bank has been doing well within these categories, particularly with trading and asset management, due to markets at an all-time high and significant corporate volume in trading activity.

Despite investment banking having strongly recovered from 2022 lows, deal activity remains below historical averages, and rate cuts induce more volume within these areas of the bank. For example, with cheaper interest rates, banks are more likely to increase their leverage and conduct buyouts due to higher expected internal rates of return. Nevertheless, the initial 50 bps rate cut from the FED has yet to improve the landscape as long-term rates haven’t fallen, and this activity is dependent on longer-term rates. Yet, the outlook for M&A and other investment banking activity is for volumes to increase to historical levels after a prolonged time of high interest rates.

Bank of America’s Stock Remains Fairly Valued

The most appalling part of a bullish investment thesis on Bank of America is its valuation. As commented, the bank sits at a potential turning point on its net interest income, and the outlook from the company’s side is for the backdrop to improve. Nonetheless, the stock wouldn’t be attractive if the bank traded at 3.00x price-to-tangible book value while exhibiting a return on average tangible common shareholders’ equity of 12.8%.

Luckily for investors, this is not the case. Based on the most recent price-to-tangible book value per share of $26.25 and a closing price of $42.62, Bank of America’s stock trades at 1.62x price-to-tangible book, which is unarguably a decent valuation, considering that the 5-year average of the price-to-tangible book multiple is around the corner at 1.60x. Simultaneously, competitor JPMorgan (JPM) trades considerably higher at over 2.3x price-to-tangible book value.

In addition, the dividend yield, at 2.30%, is also at its five-year average. With a dividend increase momentum, the current prices set an excellent opportunity for income investors who are seeking a safe and growing dividend despite the moderate value of the dividend yield.

BAC Risks: Higher Costs of Risks, Price Close to Highs

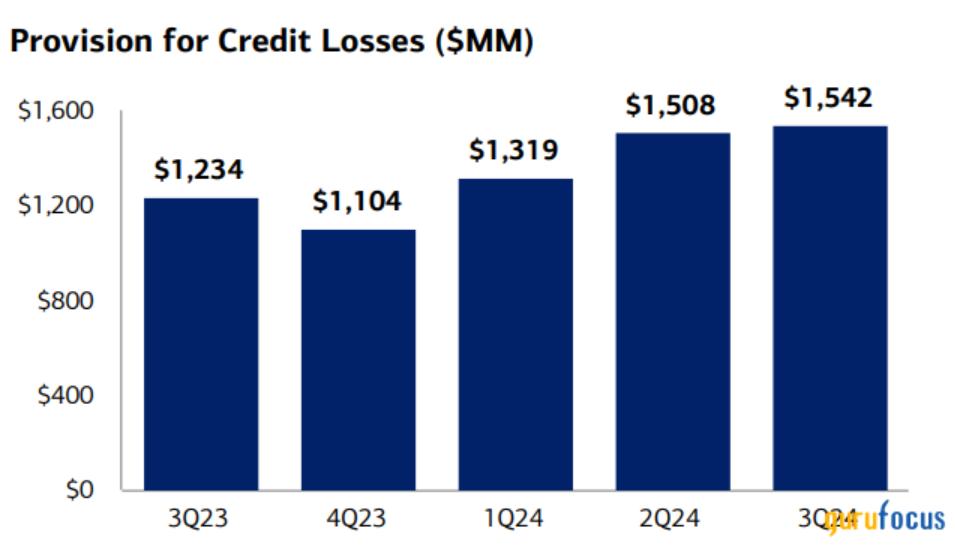

Over the past quarters, the provisions for Bank of America’s credit losses have increased slightly. Considering that the loan portfolio has stayed basically flat over the year, the bank’s cost of risk has risen. Although the bank’s asset quality remains resilient, things in the economy could always unfold. If a soft landing does not materialize, the bullish thesis on Bank of America is nullified due to a bank’s dependence on economic and credit cycles.

In addition, although the valuation remains high, the truth is like the sun; you can’t hide it with just one finger. In this case, the stock has risen more than 60% over the past year, comfortably outperforming the S&P 500 and boosting optimism among investors. Usually, when market sentiment is high, reactions to negative news amplify, and the stock tends to drop more than it should. Yet, positive financials and high market sentiment are the formula for a stock to gain excess returns.

Summary

To conclude, due to the net interest income recovery outlook, Bank of America’s stock is well positioned to continue gaining solid market performances that appeal to investors. A fair valuation allows the stock to continue being attractive to investors despite the enormous price gain of the past year. Finally, investors shouldn’t blindly follow actions from legendary investors, even more so when a bullish thesis is evident. Therefore, due to all these conditions, Bank of America is a stock that represents an opportunity in 2025.

Read the full article here