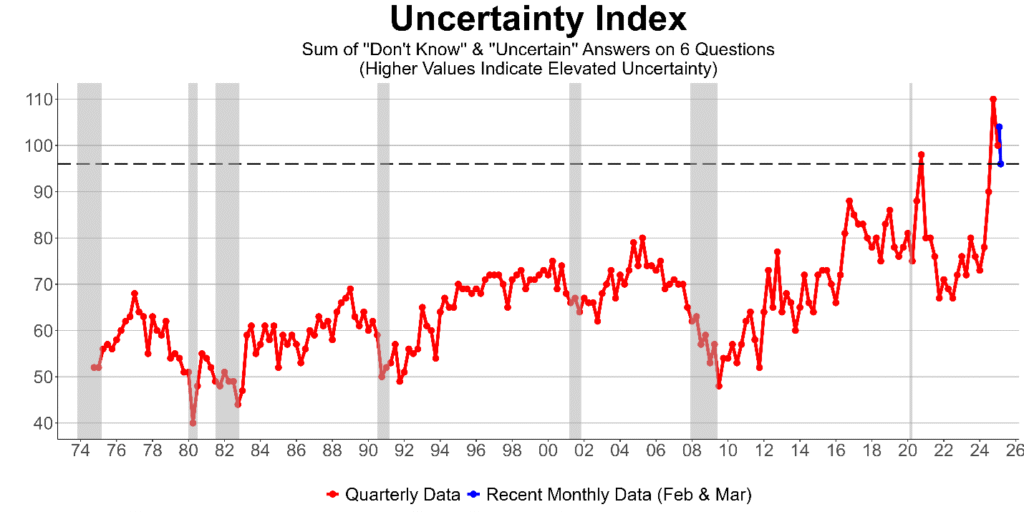

This year will be one ruled by uncertainty. Global and domestic actions are generating insecurities in abundance, both political and economic. President Trump’s administration is rearranging chairs on the deck at a record pace. Is there an “iceberg” looming ahead or will we sail through to a restructured economy safely? Since 1986, NFIB’s Uncertainty Index (based on the sum of “don’t know” and “uncertain” responses to six forward-looking questions) has averaged 68. But, since 2016 it has averaged 80 and reached a 51-year record high of 110 in October 2024.

After reaching a near-record high of 105.1 in December 2024, the Small Business Optimism Index has declined, falling to 97.4 in March (the 51-year average is 98). Since last October, the Index component “Expected Business Conditions” has moved from a net -5% to a net 52% in December. As of March 2025, it is back down to 21% expecting better conditions, “expectational whiplash”!

Inflation remains a sticky problem. Reaching 9% (CPI) a few years ago, it has fallen to below 3% (but not yet reaching the Fed’s target of 2%). From 2020 to 2024, the level of prices (CPI) increased 20%, delivering a huge reduction in purchasing power to consumers who now wish to see prices fall, not just rise more slowly. The net percent of owners raising selling prices was 26% in March, much lower than the 66% reached in March 2022 but still historically high. From 1986 to 2020, the average was 8%! It is no surprise that many small business owners still pick inflation as their most important problem, close behind labor quality and taxes. They want input prices to fall (including labor), but this usually takes a slowdown or recession, requiring reductions in selling prices as well.

Credit availability, and not credit costs, is the most important financial variable to small firms. During the Fed’s fight against inflation in the early 1980s, owners reported paying interest rates averaging 19%, compared to 8.9% in March 2025. As was the case in 1982, the Fed’s policy rate will drive the cost of loans to small firms. In 2024, the Fed started cutting its rate but stopped when inflation stubbornly refused to hit 2%. Now, tariffs threaten progress in inflation reduction, and there is speculation that if inflation picks up due to tariffs, the Fed may have to raise rates, not cut them. Then again, if tariffs bring on a recession and the usual accompanying price cuts, the Fed can continue to reduce rates to 3% or so to fight recession and boost construction. A policy rate of around 3% is the longer run target for FOMC.

Over the past 51 years, taxes (federal, state, and local) were most frequently cited as the top business problem by a wide margin. Based on surveys of a random sample of owners, taxes received the most votes as the single most important business problem (50%), followed by inflation with 12%, labor quality at 11%, and weak sales and insurance costs each with 10%. Government regulations (compliance costs) received 6% of the vote, often considered a tax, the firm must use its resources to do what the regulator wants. Financing and interest rates received a few votes (1%) but was clearly not a top concern.

On Main Street, the turbulence caused by the new economic policies will begin to show up via changes in the prices of inputs and inventories produced abroad. To the extent new policies are discouraging spending, sales will soften. Firms will respond by changing prices and employment levels. Nothing new here, small business owners only have a few options on how to move forward in these types of conditions.

Read the full article here