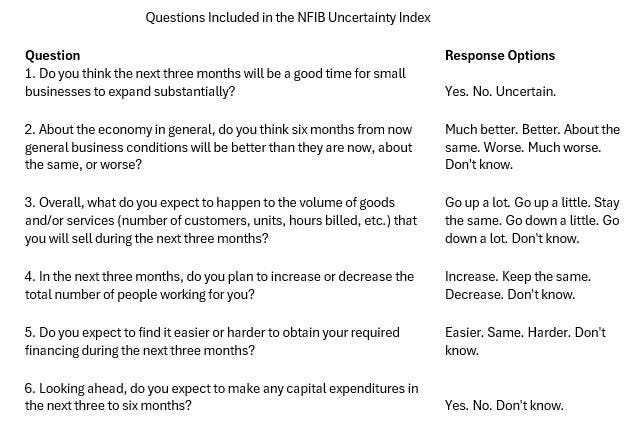

In general, uncertainty is viewed as an impediment to economic growth and progress. But uncertainty doesn’t last forever, it is produced by events which are unresolved. What counts is how that resolution occurs. Uncertainty produces inaction. For example, firms won’t raise or lower prices, increase or decrease inventories, etc. NFIB surveys a random sample of its 300,000 (approx.) member firms every month about their views, plans, and actions. Six of the forward-looking questions provide an opportunity to measure “uncertainty” by examining how many respondents answer “I don’t know” or “uncertain.” Adding up the percent of respondents who answer this way for over six questions (listed below) provides the basis for an Index of Uncertainty (see Chart 2).

The recent election produced the highest level of uncertainty in over 50 years. This comes as no surprise with the Biden/Harris (Harris/Waltz) campaign representing maintaining the status quo, and the Trump/Vance campaign representing dramatic policy change.

Uncertainty is high and rising on Main Street, and for many reasons. Economic policies are raising concerns among firms that depend on imports or compete with imports, or in the line of retaliation from countries importing U.S. goods and services. Tariffs are being broadly applied, changing the prices of imports and exports. The federal government is shedding workers and trimming expenditures. Many small businesses are assisting firms with government contracts. Will the Tax Cuts and Jobs Act be extended? How these developments are resolved will shape the economy’s future.

Confidence that the economy will continue to grow is fading, even with a new administration in place. Unadjusted, the percent of owners expecting better business conditions in the next six months lost 10 percentage points and the percent viewing the current period as a good time to expand fell 3 points to 13% (but stayed well above the 4% reading last October). Capital spending plans fell 8 points from December. All consistent with the general tone of the financial press, the economy is still growing but at a slower and slower rate; storm clouds are forming.

Inflation remains a major problem. In February, inflation ranked second as the single most important problem, behind labor quality. Owners want to see prices fall after the 20% rise over the last four years. Trump’s plan to lower energy prices could help, but history says it takes a slowdown (recession) to significantly reduce the price level. The percent of firms reporting lower selling prices has declined from 16% last year to 6% in February, a negative for inflation. The percent of owners raising and planning to raise prices (and wages) are too high to reach that 2% inflation rate for goods and services whose prices are market determined (not imputed like rent etc.). More firms report lower employment than higher. Average employment change is negative. While we wait and watch, a lot of churning is likely to occur.

Read the full article here