If you approach an intersection and you don’t know which way to turn to reach your destination, you are “frozen” in place until an external event compels you to decide: left, right, straight, or reverse? That’s how many small business owners feel today. NFIB’s Uncertainty Index is based on six questions asked of a random sample of member firms for over 50 years. Since 1986, the Uncertainty Index has averaged 68. But, since 2016 it has averaged 80 and over the last eight months, the Index has reached 51 year-high levels, the highest level hitting 110 in October 2024. For individual owners, the Uncertainty measure is the number of “uncertain” responses each owner gives to the six questions incorporated by the Index. For all firms, the Index is the sum of the percentages giving an uncertain response to each of the six questions.

Interestingly, it appears that the level of uncertainty has increased steadily over the past 50 years. Why that has occurred is unclear, possibly related to the expanding reach of government at all levels. Uncertainty in the current period is undoubtedly related to the significant changes in domestic and international policies impacting the economy. And, trying to pass a tax bill that satisfies 535 elected officials in Congress is always an uncertain process. There is a lot to worry about.

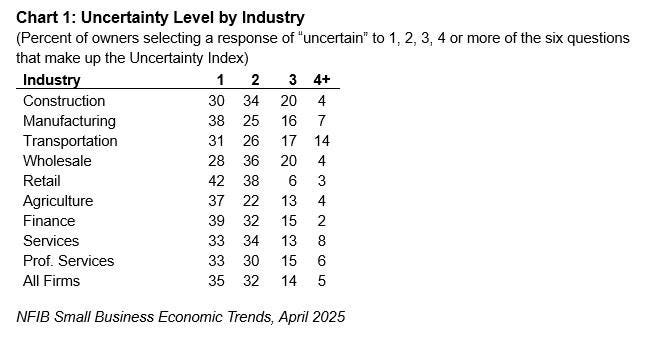

The level of uncertainty varies significantly by industry. Small business owners in the transportation industry most frequently registered high levels of uncertainty (4+). Some of this uncertainty is caused by high levels of regulation (e.g., California), tariffs, port uncertainty, and high fuel costs, to name a few. Firms in the manufacturing and services industries also expressed higher levels of uncertainty. Retail firms were least frequently found giving 3 or more uncertain responses, even with tariff uncertainty. They were more “certain” about how they are or will be impacted.

As Chart 2 shows, we are living in a period of elevated uncertainty, starting in 2016 with election issues and then again in the Covid era. Although the “Covid panic” has passed, politics, elections, and swift policy changes in D.C. continue to stir the pot of concerns. NFIB’s Optimism Index has been in recession territory for over a year, as have many traditional indicators. But, the recession stayed away. The future path may become clearer once the budget battle is done and tariff negotiations resolved.

Read the full article here