2025 is here. As investors like ResilienceVC look out at the coming 12 months, a new administration, the inexorable rise of AI and the return of risk-taking all mean we could be on the precipice of rapid change in the financial services and fintech industries. Below are 5 predictions for 2025 for the venture and fintech sectors.

1) AI as a Catalyst for Automated and Personalized Financial Resilience

The Artificial Intelligence revolution of the last couple of years will increasingly influence the landscape of financial services. Specifically, AI should push us one step closer to “set-it-and-forget-it” banking, where fully automated personal financial management (PFM) systems handle budgeting, savings, debt repayment, and credit optimization for consumers and small businesses. We don’t expect to realize this full automation in 2025, but the foundational blocks of compliant AI systems, customer comfort, and more fluid data exchange will begin to more visibly show themselves. As Adeeb Mahmud, Chief Program Officer at the Financial Health Network, says “there is still a significant opportunity to inform [AI-driven] solutions with data and insights about underserved consumers so the solutions are customized to their unique needs.”

With that in mind, keep an eye out for more and more product road maps that lean heavily towards automation. That said, an over-reliance on AI by consumers and small businesses, especially in these early days, could very well lead to poor financial outcomes if users don’t fully understand or oversee decisions. Significant user involvement will likely be required initially, and rising fraud threats will exploit vulnerabilities. Startups prioritizing transparency, education, and security – while delivering automation to underserved groups – will flourish.

2) Increasingly Custom Fintech Solutions for Niche Sectors

Embedded fintech will continue to evolve, particularly towards product offerings tailor made for specific industries. Ever-increasing proprietary data pools and growing adoption of API infrastructure will create niche opportunities in fintech. This is far from rocket science. More and more companies are finding their value not in the product they offer, but in the data behind the experience, product, and platform. From insurance products designed for hospitality workers to cash flow tools for gig economy platforms, fintech companies will increasingly customize offerings to meet the unique needs of defined sectors. And this sector-specific approach will drive adoption by solving real and bottom-up (not invented and top-down) pain points. The opportunities for startups that combine deep industry expertise with scalable, compliant technology are out there; fintech-focused investors will continue to pay attention.

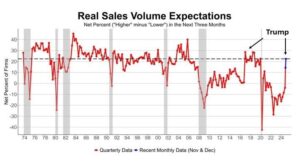

3) A Macro Environment Nudge to Fintech

The Fed lowered interest rates 3 times in 2024; that is old news. However, unless way-laid by potentially inflationary tariffs (or ongoing employment strength), the impact of these lower rates should make 2025 a year of increased credit availability and a possible surge in liquidity, nudging M&A and fintech funding activity forward. If you have not already, check out Carta’s data showing the already growing uptick in fintech activity from 2024. Big players are taking advantage of the macro environment, with Chime’s proposed IPO now in the works. Exits like that will give a liquidity boost to fintech experts, creating a new wave of ambitious early-stage innovators.

4) A Growing Risk of Unchecked Innovation

The impact of the 2024 Presidential election on financial services regulations is still stuck somewhere in the crystal ball, but the rubber will soon hit the road. While fintech relevant rules and regulations like 1033 seem likely to remain, albeit in neutered form, Elon Musk’s trial balloon dissolution of the CFPB and the new administration’s broader tendency towards deregulation could open the door for predatory financial services practices. While the absence of strong oversight can create a space for innovation to thrive, it may also expose consumers to higher risks, particularly in sectors like lending and payments. In this landscape, you will see more and more startups and investors having to take a proactive role to ensure ethical and helpful innovation. Hopefully the new administration will take some initiative and incorporate industry experts into any new regulatory frameworks, as Gilles Gade of Cross River Bank recently argued in the American Banker.

5) Financial Resilience Challenges in a Deregulated Environment

As regulation subsides, real challenges in financial resilience will intensify. Rising tariffs and the threat of tariffs may drive up prices, housing affordability will remain out of reach for many, and ever-higher consumer debt will threaten household balance sheets. While no one mentions egg prices anymore, the everyday cost of living will continue to weigh heavily on low- and moderate-income households. You will continue to see a growing pool of successful innovators who are building profitable businesses by helping drive financial resilience.

For ResilienceVC, we will be searching far and wide for founders that are driving healthy innovation and focusing on promising economics over hype. As an industry, we must play a greater role in monitoring the financial health impact of the latest and greatest financial technologies. Regularly assessing financial resilience, perhaps through a nationwide score, will be critical. Through careful progress, 2025 can be the year of Fintech.

What predictions do you have for the new year?

Read the full article here