Stablecoins, such as Tether, are attracting considerable attention. Last year when the Stripe CEO Patrick Collison, called stablecoins “room-temperature superconductors” for financial services (after paying $1 billion for Bridge), I for one did not view his comments as hyperbolic in the least, and now that Stripe has bought Privy (which has some 75 million stablecoin wallets out there), I think we can safely say that stablecoins are marching into the mainstream.

Stablecoins Are Here To Stay

Stablecoin is a misused word. It originally meant a digital asset, some form of token, that had its value maintained at a fixed level with reference to an external benchmark via algorithmic management of supply and demand. Now, however, the word has come specifically to mean a kind of digital asset that is institutionally bound to fiat currency, either by maintaining a 100% reserve in commercial bank deposits in that currency or by holding a 100% reserve high-quality liquid assets denominated in that currency (eg, treasury bills).

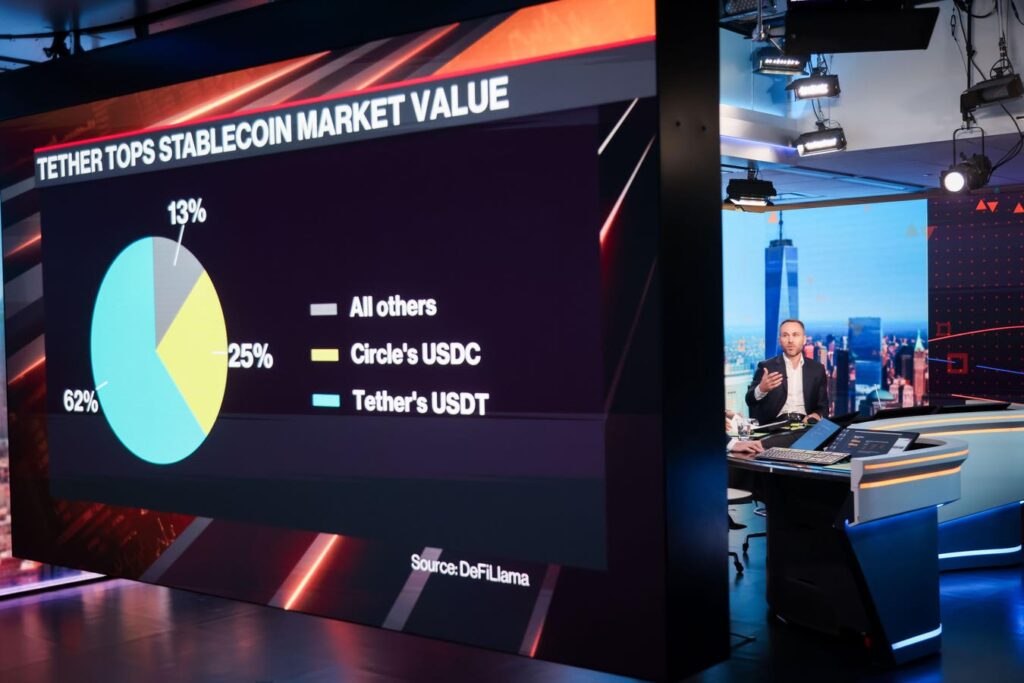

Globally, stablecoins are on a tear and in almost all cases the cash and assets are the US dollar and dollar securities. The two largest stablecoins out there right now are Tether (USDT; $149 billion) and the USD Coin from Circle (USDC; $62 billion). Circle’s IPO, also last week, saw shares jump as high as $103.75 from the offer price of $31 with heavy investor demand.

Tether and Circle therefore account for some $240 billion in circulation. This is not much in the $36 trillion US Treasury market, but the growth has certainly focused US Treasury’s attention. Why? Well, I agree with Marc Rubenstein’s analysis on this: when I bought my first stablecoin, it was in order to play around in “crypto”. But it is now clear that stablecoins are decoupling from cryptocurrency and their adoption is driven by “practical applications rather than speculation“. It seems that Stablecoin transactions, broadly speaking, support real world business. For example, Elon Musk’s SpaceX uses stablecoins to repatriate funds from selling Starlink satellites in Argentina and Nigeria, while ScaleAI (the data labelling and AI training company that Meta has bought a 49% stake in, for nearly $15 billion) offers its large workforce of overseas contractors the option of being paid this way.

A recent YouGov survey (commissioned by Visa and others) of 500 cryptocurrency users in each of five emerging markets found that stablecoins are increasingly seen as not only a practical application of the new transaction technologies but a “core application” in the crypto space, offering practical solutions such as currency conversion, remittances and payment for goods.

Recent developments look like powering stablecoins across many sectors. Bridge just launched stablecoin issuance APIs that allow developers to issue USDB, its internal stablecoin, or spin up white-labeled stablecoins backed 1:1 by USDB (with free conversion to USDC). And with Bridge as the stablecoin pipes and Privy’s wallets as the front-end, users will be able to spin up wallets for their clients while, as Noelle Acheson says, abstracting away the hassle to the point where users need not even know they’re using a wallet – with Privy and Bridge integrations, transactions would become as easy as “click here to pay”, and balances could show up in simple and familiar web accounts.

The ability to move money around without hassle will undoubtedly reshape the global financial system, because stablecoins are about more than making payments cheaper for supermarkets or easier for small businesses in other countries. Martin Sandbu, writing in The Financial Times, says that the international payment system is on the cusp of huge change for both political and technological reasons. He is right, of course, For one thing, the weaponisation of the dollar-based financial system — note how the US has cut off access to SWIFT in certain circumstances — has prompted quests for alternatives from allies and adversaries alike.

(You might see this quest as of central importance in the financial world and perhaps even, as I wrote in my 2020 book The Currency Cold War, a new space race, in which “to the moon” has a very different meaning.)

Regulators have concerns. A key official whose job it is to consider the digitalisation of money at a developed world central bank returned from the Spring International Monetary Fund-World Bank meetings with a deep sense of unease. commenting “There is a wall of $!1* money coming our way, and we’re doing nothing about it”. He was referring to the central banking community at large. And he’s right.

He is right for two reasons. The first is that stablecoins threaten central bank control over settlement assets. While some central banks are looking to connect existing payments systems with the next generation token-based infrastructure, others (including the European Central Bank) think that the markets need nothing short of tokenised central bank money and that if they do not provide it then the participants will use stablecoins instead.

The second reason is, of course, that these stablecoins are almost all pegged to the US Dollar and the seigniorage accrues not to the Fed or any other central bank but to private operators.

These drivers have implications both for America and for the rest of the world. For example, a Russian plan to break the grip of the US dollar through a new international payments network went nowhere are the BRICS summit in Kazan last year. Despite all of the talk of new reserce currencies, dollar-backed stablecoins are the choice of indiviuals and businesses the world over.

This is why the policymakers have a genuine concern that if US stablecoins gain widespread usage, there is a risk of “digital dollarisation” where platforms mean that participants will stay in flexible, liquid digital dollars and effectively undermine national sovereignty in monetary policy.

Stablecoins Are Not Banks

One more important point to make. The discussion about the relationship between stablecoins and banking has been vigorous in recent weeks, but from the bank perspective, I think that stablecoins are an opportunity. Banks and stablecoins are apples and oranges. I am fond of quoting Morgan Ricks, a professor at the Vanderbilt Law School and a former Treasury official, on this. He said

There’s nothing inherently dodgy about stablecoins. But there is something inherently dodgy about banking, which is why countries build elaborate regulatory regimes to protect deposits.

The banking technology commentator Tom Noyes says the idea the stablecoins will supplant established retail banking relationships is a bunch of “hooky” and goes on to make the point that banks are actually well-positioned to take advantage of innovation in this area. I am sure he is right which means that whether you are in the US or anywhere else, your bank, fintech or payment services organisation needs a stablecoin strategy.

Read the full article here