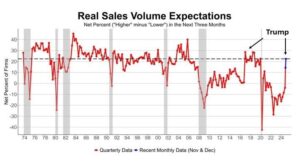

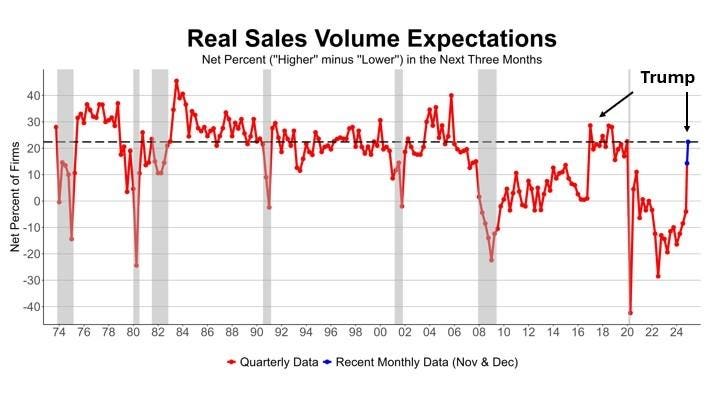

In August 2024, expectations about real sales growth were extremely negative, with a net -18% (s.a.) expecting higher real sales in the coming months (more firms expected declines than increases). The percent expecting lower sales exceeded the percent expecting gains for 34 months prior to the November 2024 election. In November, net positive views improved 18 points to 14% and to 22% in December, a remarkable turnaround (Chart 1). From 1982 to 2008, the net percent expecting higher real sales averaged 22%. Sales expectations started to drop at the end of 2007 and turned negative in 2008. During Trump’s first term, real sales expectations were positive but returned to negative balances in response to Covid and high inflation.

By industry, manufacturing was most optimistic with a net 34% expecting improved real sales. This sector has been underperforming for years, so they are looking to grow, a fresh start. Firms in finance and real estate are equally positive about sales. Firms in the two services sectors have a positive view of sales growth but less exuberant.

On the downside, firms in construction, transportation and communication, and agriculture still have a negative view for sales growth. The trades were balanced, with about as many owners expecting sales improvements as expect sales declines.

Overall, the picture is mixed, with some sectors positively impacted by the election results while others did not perceive an improvement in prospects. The manufacturing PMI has been in the dumps, so it appears that those firms expect an affirmative change in economic conditions. Firms in finance are counting on the Fed to stabilize financial markets. As the new government takes shape, firms will receive clearer messages about future economic policy and potential impacts on their businesses.

Read the full article here