Alex Kreger, UX Strategist & Founder of the financial UX design agency UXDA, designs leading banking and fintech products in 37 countries.

The banking industry is undergoing an unprecedented transformation as the digital revolution reshapes how financial services are delivered and consumed. Traditional banking models, once dominated by physical branches and face-to-face interactions, are being upended by the rise of digital technologies.

This shift has given birth to digital brands in banking, heralding a new era where financial brands must evolve to meet the changing expectations of tech-savvy customers. As the founder of UXDA, a fintech user experience design agency, I want to explore the emergence of digital brands in banking, the factors driving this change, and its implications for the future of financial services.

A Paradigm Shift in Customer Expectations

Today’s consumers live in a digital-first world. Smartphones, tablets and laptops are integral to daily life, influencing how people communicate, shop and manage their finances. According to a survey by the American Bankers Association, 71% of bank customers prefer to use mobile or online banking, while only 14% use branches and call the bank. The convenience of digital platforms has set new standards for accessibility and user experience.

Modern consumers demand:

• Convenience: Access to banking services anytime, anywhere.

• Speed: Real-time transactions and instant account management.

• Personalization: Customized products and services tailored to individual needs.

• Transparency: Clear information about fees, rates and terms.

• User-Friendly Interfaces: Intuitive digital products that simplify complex financial tasks.

I’ve seen traditional banks, with their legacy systems and bureaucratic processes, often struggle to meet these demands. This gap has paved the way for digital brands that prioritize customer-centricity and technological innovation.

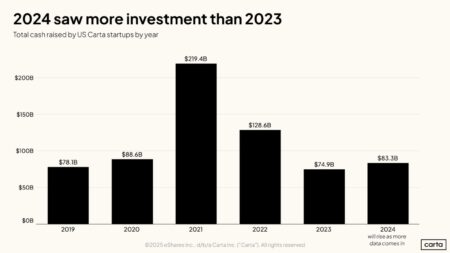

The Rise Of Fintech And Challenger Banks

The financial sector is highly competitive, with traditional banks, fintech startups and tech giants vying for market share. Companies that invest in their digital brand can differentiate themselves by offering unique value propositions and superior customer experiences.

Digital branding enables financial institutions to highlight their innovations. Fintech startups and challenger banks have capitalized on this opportunity by offering digital-first banking solutions. Companies like Nubank, Revolut, Wise, Plaid, Stripe and Chime have built brands entirely around digital experiences, attracting millions of users with their sleek interface, low fees and innovative features.

Digital brands in banking remove expensive physical branches to offer more accessible, cost-efficient services, leverage data analytics and AI for personalized insights and embrace open banking to enable collaborative innovation. They spotlight social and environmental commitments to achieve meaningful impact while simplifying cross-border transactions at competitive rates.

Real-time payment systems allow instant transfers and improve overall satisfaction. Through inclusive services, they can extend financial access to underbanked communities. Forming partnerships with tech providers and non-financial brands helps create holistic and embedded solutions. By prioritizing a seamless customer journey, they are able to deliver a convenient, rewarding experience.

Finally, crypto-friendly services enable digital brands to expand possibilities in emerging markets by integrating digital assets, blockchain solutions and next-gen investment opportunities.

Building Digital Trust In Banking

Today, establishing trust goes far beyond guaranteeing secure transactions. It requires banks and fintechs to be transparent, consistent and hyper-focused on delivering genuine value through digital experiences. In the digital realm, customers can’t rely on face-to-face reassurance; instead, they look to the brand’s digital footprint: user reviews, network presence, app design, digital experience and every online interaction that conveys credibility and authenticity.

Companies looking to break through in this age of digital banking and remain competitive should prioritize the following best practices:

• Always be available. Digital brands must be open to solving problems and interacting through a digital channel that is convenient for the user. You can use this approach to continuously improve your products.

• Focus on customer centricity. Digital banking leaders need to understand that users expect an intuitive experience and real-time updates. Therefore, they should provide seamless interfaces and thoughtful notifications, reminding everyone that convenience really is above all else.

• Innovate with purpose. To be a competitor in digital banking, leaders should focus on simplifying processes like the sign-up process, eliminating pitfalls, providing transparency and integrating smart money management tools.

• Focus on authentic engagement. Avoid relying solely on “token engagement” like advertising and technical messages. Encourage open conversations and meaningful topics on your platform that evoke an emotional response and build an active brand community that leads to long-term loyalty.

• Create a distinctive identity. A dated corporate look and a one-size-fits-all digital service might have worked 10 years ago, but modern consumers crave more. To stay competitive, digital-first banking brands must invest in tailor-made product design and vibrant brand authenticity—showing incumbents that a consistent digital identity is more than window dressing; it’s a business imperative.

Conclusion

The dawn of digital brands in banking signifies a transformative period where customer expectations, technological innovation and competitive pressures converge. Financial brands that successfully navigate this landscape will be those that embrace digital service not merely as a marketing strategy but as a fundamental reimagining of their business models and brand propositions.

In the future, digital brands in banking will hinge on AI-driven personalization—delivering customized advice and proactive insights—while banks transform into multi-service platforms that embed finance within non-financial ecosystems and embrace open banking collaborations. Alongside these technological advancements, ethical and sustainable practices will gain greater emphasis through social responsibility and eco-friendly financial products.

As cyber threats escalate, financial institutions will fortify defenses with AI-driven security protocols and enhanced privacy controls, ensuring users can both trust and shape how their data is used in this increasingly interconnected environment. The future of finance belongs to those who recognize that the digital revolution is not just about adopting new technologies but about redefining what it means to be a financial brand in the digital century.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

Read the full article here