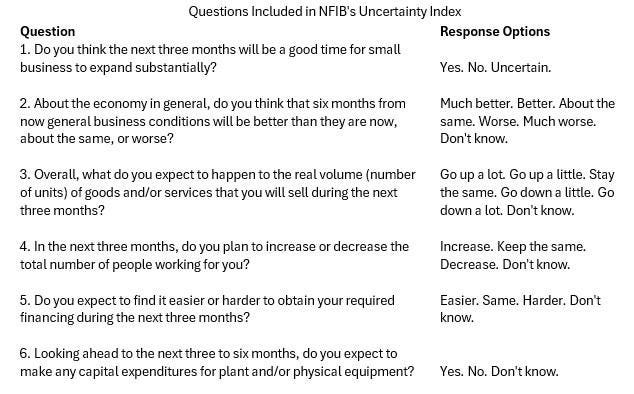

The 2024 election is one of the most confusing in recent history, with candidates confirmed just a few months before the election. With a very short period of time for campaigns, there is less information available to base decisions on. With a little over a month before the election is over, uncertainty has become more widespread. For over 50 years, NFIB has measured uncertainty by examining the percent of owners who cannot give a directional (up or down) response to six questions about their business environment in its monthly Small Business Economic Trends survey. NFIB asks a series of forward-looking questions, all of which have a “don’t know” or “uncertain” option for the owner to choose. These are listed below:

In the monthly surveys, the Uncertainty Index peaked at 100 in November 2016 (Chart 2). Quarterly (the first month in each quarter with larger samples), the record high was 98, reached in October 2020. The current reading of 92 (August) is one of the highest recorded, up 19 points since January of this year. This illustrates how uncertainty hurts economic growth. The rise in uncertainty coincides with a slowing of the economy, less hiring and spending.

The election will resolve a lot of uncertainty as owners will know which political party will be in charge of spending, taxation, and regulation. These government activities are critical to small businesses. With more certainty, more owners can make decisions about hiring and spending and the projected course of the economy. If they like the outcome, more owners will spend and hire, moving the economy forward. With nearly 15 million firms with fewer than 5 workers (NAICS), even small changes can add up to big numbers.

Read the full article here