The best way to keep inflation down is to get output up. In President Trump’s first term, energy costs were reduced by increasing US production of oil and gas. Oil and gas are “in everything” as an input to production, so reducing their cost lowered the cost of producing “stuff.” For example, making too many cars reduces their price, while not producing enough eggs raises egg prices, solved only by increasing the supply (invest in chickens). It’s economic silliness to try to “whip inflation” by controlling prices, that just reduces supply even more. Senator Sanders wants to cap interest rates at 10%. This is great if you are paying 20%, but will banks supply credit to you at that rate of return? The economists in the last administration didn’t seem to understand that, deciding to lower prices on electric vehicles by providing subsidies – subsidies paid by other taxpayers and passed on to producers to cover their cost. What happened to prices with the supply chain disruptions? They went up and started falling once ports and trucking started functioning and delivering goods. Trying to regulate prices is counterproductive as competition is the best regulator of prices.

The main purpose of business investment is to increase supply and reduce costs, permitting more to be sold at lower prices. Better shovels help a worker move more dirt per hour, but a backhoe is even better. Training workers is an investment with big payoffs. For example, scanners reduce labor costs at stores. Small business owners employ over 40% of the private sector workforce so their investment decisions are crucial to worker productivity, and consequently to worker pay. NFIB’s Small Business Economic Trends report found that in February, of those making a capital expenditure 37% reported buying new equipment, 30% new vehicles, and 13% improved or expanded facilities. Twelve percent bought new fixtures and furniture, and 5% acquired new land and facilities.

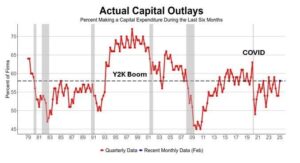

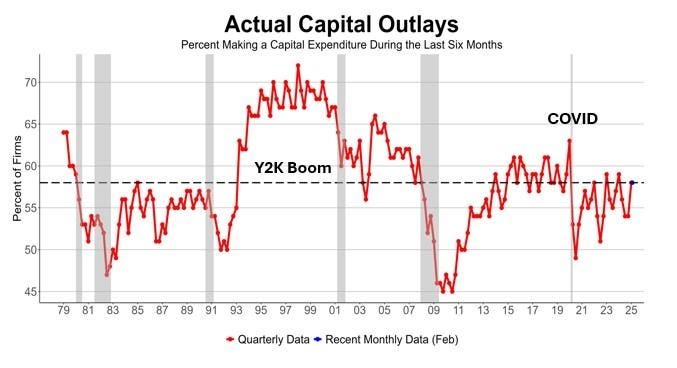

Investing activity has historically been on a roller coaster ride on Main Street. The largest surge in the past 51 years was caused by the uncertainty surrounding the Y2K event. Dates in computers were stored as two digits (memory space was an issue in those days), but what would all the computer programs running everything do with “00”? A lot of money was spent on new stuff to avoid finding out. The spending spree ended sharply after New Year 2000, triggering a modest recession. Investment activity was good in the first Trump era, then Covid struck and the economy was shut down, recovering a bit, but remaining weaker than the 2015-20 period. It is hard to discern a “normal” level of spending activity from the 51 years of data.

Preserving the Tax Cuts and Jobs Act (TCJA) provisions that are set to expire at the end of 2025, especially the 20 Percent Small Business Deduction will be very supportive of future investment in the small business sector, supporting the growth in output needed to keep inflation down.

Read the full article here