As the best year in crypto’s history comes to a close, it’s worth looking back at how it went and where it leaves us for 2025. BTC led the show this year. It began with the U.S. Security and Exchange Commission (SEC) approving spot bitcoin ETFs from Blackrock, Fidelity, and other top institutions.

Then the fourth Bitcoin Halving happened in April. Options contracts went on spot bitcoin ETFs, catalyzing mass adoption. American and Russian lawmakers proposed strategic bitcoin reserves, and then, the big milestone, bitcoin crossed the much-awaited $100,000 mark in early December.

But 2024 wasn’t only about Bitcoin’s success. It was also about key infrastructural upgrades and cutting-edge innovations across Layer-2s, Real-World Assets (RWAs), and Crypto AI. Stablecoins, the the killer app in digital assets delivering the fiat on and off ramps to Web3.0 exploded in 2024 with a number of new issuers and a market cap of over $200 billion, and memecoins had a great run this year, garnering much interest from retail users and investors.

Both retail and institutional interest led to holistic industry growth in 2024, driving new use cases and solving for real-world problems.

Building The Fundamentals Of Crypto Finance

Bitcoin ETFs have reached a market cap of over $132 billion, with more than $10 billion inflows since Donald Trump won the American presidential election.

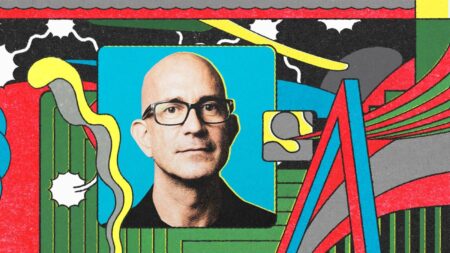

2024 was also about the winds of political change and a new pro-crypto administration in the U.S. The appointment of former PayPal exec David Sacks as AI and crypto czar, and the appointment of former college football player and Republican congressional candidate Bo Hines to the Presidential Council of Advisers for Digital Assets, chaired by Sacks, is helping 2025 to take shape rapidly.

Add Paul Atkins who will become the new SEC Chair role, replacing Gary Gensler who will resign on January 20th, and the anticipated appointment of Brian Quintenz, a16z exec and the crypto policy right hand of former CFTC Commissioner Chris Giancarlo, crypto dad and uber crypto policy czar – the team that delivered the bitcoin future market, and it looks as if the U.S. is positioning to dominate crypto, globally.

Ryan Chow, co-founder and ceo of Solv Protocol, says, “The approval of bitcoin ETFs has legitimized the asset class as an institutional grade investment. Besides the incoming liquidity and positive price activity, bitcoin ETFs have increased BTC’s popularity. It’s not surprising that Bitcoin DeFi has attracted more than $3 billion in TVL, despite its nascency.”

Alongside bitcoin, AI emerged as a leading narrative, dominating crypto mindshare with an all-time high of 48 percent by November. Currently, the crypto-AI sector has a market cap of over $34 billion with a strong growth potential.

Tiancheng Xie, co-founder and cto of Polyhedra Network, explained, “AI’s biggest challenges revolve around trust, transparency, and accountability, by utilizing blockchain in-particular zero knowledge proofs we can ensure verifiable data, fair contributor compensation, and a trustless builder ecosystem, which in-turn creates scalable innovation in a more trusted environment.”

According to a16z’s Builder Energy dashboard as well, crypto developers are heavily focussing on AI with over 34 percent of projects using AI in 2024. The dashboard also shows building blockchain infrastructure is the second most popular category this year with over 19 percent builder activity. According to a16z’s Builder Energy dashboard as well, crypto developers are heavily focussing on AI with over 34 percent of projects using AI in 2024. The dashboard also shows building blockchain infrastructure is the second most popular category this year with over 19 percent builder activity.

Ben Wynn, cmo at House of ZK, echoed how infrastructure developments have been a major focus for the industry to increase overall capacity, saying, “Blockchain development continues to grow significantly, with over 23,000 monthly active developers globally in 2024 – a roughly 40 percent annual increase since 2015 – and ZK is growing even faster, with over a 50 percent annual growth over the past four years. ZK deployments have surged from 40 in 2020 to approximately 640 in 2024 – a 16x increase – reflecting its transition from mostly theoretical to more practical use, and it’s becoming widely recognized as the foundation for solving the pressing challenges of scalability, privacy, interoperability, and more.

“Its potential to transform every facet of blockchain is clear and, with adoption quickly accelerating, we expect developer activity in ZK to grow exponentially in the coming years”

Overall, infrastructural improvements on the back-end are having a big positive effect in onboarding new users to crypto.

Taking Crypto To The Masses

In September 2024, a record-breaking 220 million wallet addresses interacted with a blockchain at least once, the highest ever in crypto’s history. On average, there are 30-60 million monthly active crypto users currently, or around 5-10 percent of the 617 million global crypto owners.

The surge in on-chain interactions has been primarily driven by Solana, NEAR, and Base. Interestingly, Solana and Base also lead the list of chains in builder interest. Meanwhile Base, with a 10.7 percent builder interest, has some of the most popular memecoin projects like Brett and Goose.run driving user adoption.

Memecoins are now a $130 billion industry, despite all the controversies surrounding this asset class. Many analysts consider the sudden rise of memecoins in 2024 as a speculative fad and aberration, with others considering it the epitome of digital culture and successfully leveraging speculation as a use case. As Riva Tez of LayerZero Labs said at Consensys 2024, memes have helped crypto win the “narrative war”.

Likewise, Momin Saqib, Brett ambassador, emphasized the memecoin narrative while noting, “Memecoins capture the spirit of the internet—playful, inclusive, and dynamic while their communities provide a rare sense of belonging in a day and age where loneliness is an epidemic in modern society. Brett for me stands out as a beacon of connection—uniting people through humor, vibrant communities, and shared experiences. It has become a movement that transforms digital engagement into joy, purpose, and inclusivity, all while driving real-world impact through its inspiring charitable initiatives in water and education.”

Besides community formation, Ryan, core contributor of Goose.run, explained how memecoins create novel wealth-generating opportunities saying, “By monetizing meme’s virality, memecoins have shown how speculation can be a utility in itself. If memecoins, however, stay isolated in speculative trading, they’ll miss out on enormous untapped liquidity. It’s important to create a sub-sector of Meme Finance (MemeFi) to leverage memecoins in DeFi to maximize their use cases.”

Despite not being blue chip assets, memecoins are the second-most popular category dominating market narrative mindshare. Drew Cohen, marketing lead of GME on Ethereum, considers the spectacular success of memecoins as a revolt against VC-backed coins.

Cohen explains, “Retail investors don’t have free and fair entry points for VC-backed tokens because the coins already have high valuations at launch. Memecoins create an equitable opportunity for everyone that challenges the VCs as gatekeepers of crypto finance. Thus, memecoins give power back to the masses.”

Hatu Sheikh of Ape Terminal, also emphasizes the importance of retail investors in the crypto economy saying, “No industry can flourish until the general public invests in your projects. After all, institutional investors can only do so much. Protocols need to have a strong and diverse user base who will invest and become your most vocal marketing support in the long run.”

As 2024 draws to a close, we see a simultaneous rise in bitcoin, infrastructure investment, institutional liquidity, and memecoings. Perhaps for the first time in fifteen years, there’s no one winner – in 2024, everyone’s a winner – this time, it is appears very different.

Read the full article here