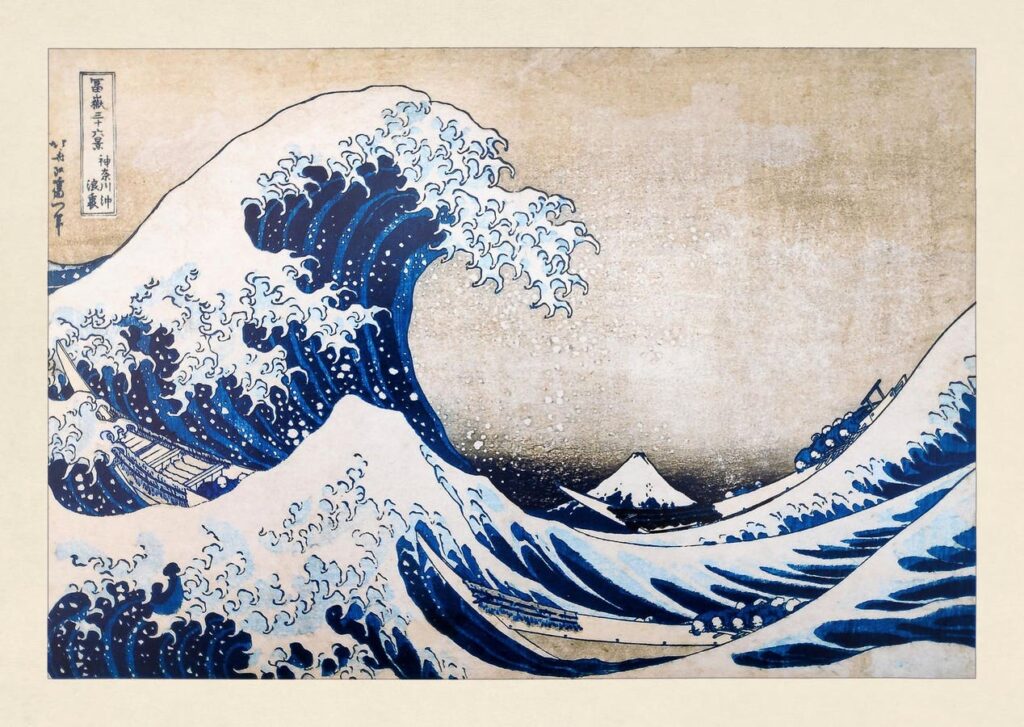

The “Silver Tsunami,” a term coined nearly two decades ago, originally warned of a looming healthcare crisis. Today, its impact extends far beyond.

One area relates to small business transitions. Across nearly every industry, as baby boomers retire in record numbers, small businesses will need to find new owners or be shut down. In the U.S., almost half of small businesses are owned by baby boomers, with around 4.5 million expected to change hands in the next decade —representing a staggering $14 trillion in wealth.

Yet many have no transition plan, and as we go into in the piece below, current options often don’t work.

Well, there might by another way. A wave of new innovative models is emerging to support small business generational transition. In this piece we deep-dive into four business models.

Next Gen SMB Brokerage

Most SMBs —particularly on the “S” side of it, are family businesses. Yet, when an internal transition within other family members is not an option, owners’ options tend to narrow down quite a lot. Selling the company might seem like an obvious option, but there are several challenges for small businesses to successfully go through this path. Institutional buyers like Private Equity (PE) firms, tend to target more the “M” segment of SMBs, often seeking companies with at least $5-10 million in EBITDA. Further, the complexity of due diligence and negotiations can be daunting for small business owners unfamiliar with the process.

For smaller businesses, selling to local entrepreneurs remains an option, though this market is highly illiquid, with fewer than 30% SMBs successfully finding buyers. These challenges underscore the need for innovative solutions to address the growing wave of SMB transitions.

This is where SMB brokerage platforms come in. They combine traditional IB/brokerage services with AI and technology to scale, typically focusing in the mid-market segment. The M&A Research Institute, a Japanese unicorn is a great example of this model. In the US, Acquire (focused on SAAS), Iconic (note: a portfolio company of the fund I work with), and Offdeal are building in this category.

SMBs marketplaces

Marketplaces are emerging to simplify the process further. Similar to how Zillow and Redfin transformed real estate, emerging platforms are facilitating the discovery of sales and, in some cases, enabling transactions to be completed digitally – particularly for the smallest transactions.

The incumbent, BizBuySell, dominates the space with ~65k listings and 3.5 million monthly visits. Yet, new players like Baton Market (a portfolio company for the venture capital fund I work in) are providing innovative tools including valuation for SMB owners. Others like Bizdaq are emerging in other geographies (in this case the UK) or focused on certain sectors (e.g. Flippa in ecommerce).

The big challenge for this model is being able to attract high-quality businesses, address long sales cycles by building trust with sellers, and leverage technology to automate key parts of the process.

Employee Ownership Models:

Historically, business owners could either sell their business to new owners or private equity, or cobble together a solution to sell to their employees.

New models are emerging to make this possible. In the U.S. Teamshares is pioneering a model to facilitate employee ownership of small businesses. The company acquires SMBs, provides owners with an exit, recruits new leadership, and transitions ownership to employees over time. Its unique approach grants employees 10% of the company’s stock at acquisition, increasing to 80% ownership over 20 years—earned through service rather than purchase. This preserves the business legacy, empowers employees, and aligns incentives to enhance productivity and morale.

Teamshares also leverages a proprietary software platform to streamline the process, offering tools for due diligence, financial modeling, and post-acquisition integration. With over 90 businesses acquired across 31 states and 42 industries, Teamshares aims to build a network of 10,000 employee-owned companies. While the model shows promise for many general verticals, industry-specific challenges and regulations may limit its applicability in certain sectors.

A range of players are emerging to create sector specific approaches to Teamshares in different markets. For example, Meroka and Sevi Health focusing on healthcare. The sector is also globalizing, as a recent piece by Sifted showed about the growth of tech-enabled private equity players in Europe.

Enablement platforms

New players are emerging to simplify the sales process across all vectors.

For example, platforms are emerging to simplify employee ownership models. Village Labs is creating software and AI tools to make the ESOP setup and management process more accessible. Companies like Common Trust are powering Employee Ownership Trusts (EOTs).

New platforms are helping to evolve the SMB brokerage space. Finally, there are Tech platforms revolutionizing the M&A process for traditional SMB brokerage and investment banking firms by streamlining complex workflows and increasing efficiency. These platforms offer tools for automating critical steps like financial modeling, due diligence, and document creation, significantly reducing the time and effort required to close deals. AI-powered matching algorithms are enhancing buyer-seller connections by identifying synergies and optimizing transaction outcomes. Additionally, valuation software, virtual data rooms, and secure digital signing solutions are enabling firms to manage transactions more effectively while maintaining transparency and compliance. By integrating technology into their operations, SMB brokers and investment banks can handle a higher volume of transactions, reduce costs, and provide a smoother experience for clients. Companies in this category include Optionality, using AI to improve the M&A process from deal sourcing to execution and Zolidar, developing tools to help SMB owners transition to employee ownership.

__

We are in the early days of the silver tsunami. We are also in the early days of the tech-response in this category. One thing for certain, this is a sector to watch.

Read the full article here