Did you know corporate bankruptcies hit a 14-year high in 2024? Almost 700 companies filed for bankruptcy, and among them were big name companies like Red Lobster, Spirit Airlines, Big Lots, Party City and more.

As Trump shakes up the global economic landscape, many business models look increasingly wobbly. I’m not surprised to see many stocks plummet even if the company beat earnings expectations.

For example, AI chipmaker Marvell Technology (MRVL) beat both revenue and EPS estimates, but its stock fell more than 18% on the day of earnings. Even beats aren’t sending shares soaring anymore, as investors look past the meaningless EPS figures and weigh future economic uncertainty against already overvalued stock prices.

Looking for a safe haven in this uncertain market? My firm has answers. I leverage my firm’s superior fundamental data to bring truth to the markets. How? I calculate the real cash flows of businesses and deliver the truth about stock valuations.

I scour my proprietary database to identify companies that not only generate real cash flows but also generate enough cash flows to easily cover their dividend payments. Growing dividends are a great way to protect a portfolio in uncertain times. Finding companies with the ability to grow their dividends can lead to a gold mine. That’s exactly what my Dividend Growth Stocks Model Portfolio finds.

The report below features one stock from this Model Portfolio.

Stock Feature: The Hershey Company (HSY)

The Hershey Company (HSY) is the featured stock in the most recent Dividend Growth Model Portfolio.

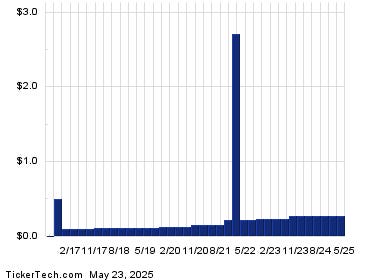

Hershey has grown revenue and net operating profit after-tax (NOPAT) by 7% and 15% compounded annually, respectively, over the last five years. The company’s NOPAT margin increased from 18% in 2019 to 25% in 2024, while invested capital turns fell from 1.0 to 0.9 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns and drive return on invested capital (ROIC) from 17% in 2019 to 22% in 2024.

Figure 1: Hershey’s Revenue & NOPAT Since 2019

Free Cash Flow Supports Dividend Payments

Hershey has increased its regular, quarterly dividend from $0.72/share in 1Q19 to $1.37/share in 1Q25. The quarterly dividend, when annualized, equals $5.48/share and provides a 3.1% dividend yield.

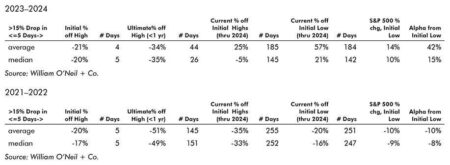

More importantly, Hershey’s cumulative free cash flow (FCF) easily exceeds its dividend payments. From 2019 through 2024, Hershey generated $6.7 billion (17% of current enterprise value) in FCF while paying $4.7 billion in dividends. See Figure 2.

Figure 2: Hershey’s FCF vs. Dividends Since 2019

Companies with FCF well above dividend payments provide higher-quality dividend growth opportunities. On the other hand, dividends that exceed FCF cannot be trusted to grow or even be maintained.

HSY Is Undervalued

At its current price, Hershey has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects Hershey’s NOPAT to permanently fall 10% from current levels. This expectation seems overly pessimistic given that Hershey has grown NOPAT by 15% compounded annually and 11% compounded annually over the past five and ten years, respectively.

Even if Hershey’s:

- NOPAT margin falls to 20% (equal to five-year average and below 2024 margin of 25%) and

- revenue grows 4% compounded annually (compared to 7% compounded annually over the last five years) for the next decade,

the stock would be worth $218/share today – a 23% upside. See the math behind this reverse DCF scenario. In this scenario, Hershey’s NOPAT would grow just 2% compounded annually through 2034.

Add in Hershey’s 3.1% dividend yield and a history of dividend growth, and it’s clear why this stock is in February’s Dividend Growth Stocks Model Portfolio.

Critical Details Found in Financial Filings by My Firm’s Robo-Analyst Technology

Below are specifics on the adjustments I make based on Robo-Analyst findings in Hershey Inc.’s 10-K:

Income Statement: I made over $850 million in adjustments with a net effect of removing over $550 million in non-operating expense.

Balance Sheet: I made just over $6 billion in adjustments to calculate invested capital with a net increase of over $3 billion. The most notable adjustment was for asset write downs.

Valuation: I made over $6 billion in adjustments, with a net effect of decreasing shareholder value by just under $5 billion. Apart from total debt, the most notable adjustment to shareholder value was for excess cash.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Read the full article here