Tariffs are a hot topic these days. We will discuss in simple terms what they are, how they work, and who pays the bill. We’ll also look at the trade imbalance of the United States during the past 78 years. In short, you will see when the U.S. had a trade surplus and when there was a trade deficit. Hint: America has had a trade deficit in about 90% of the years since 1947. Understanding tariffs and who pays is crucial these days.

What Are Tariffs?

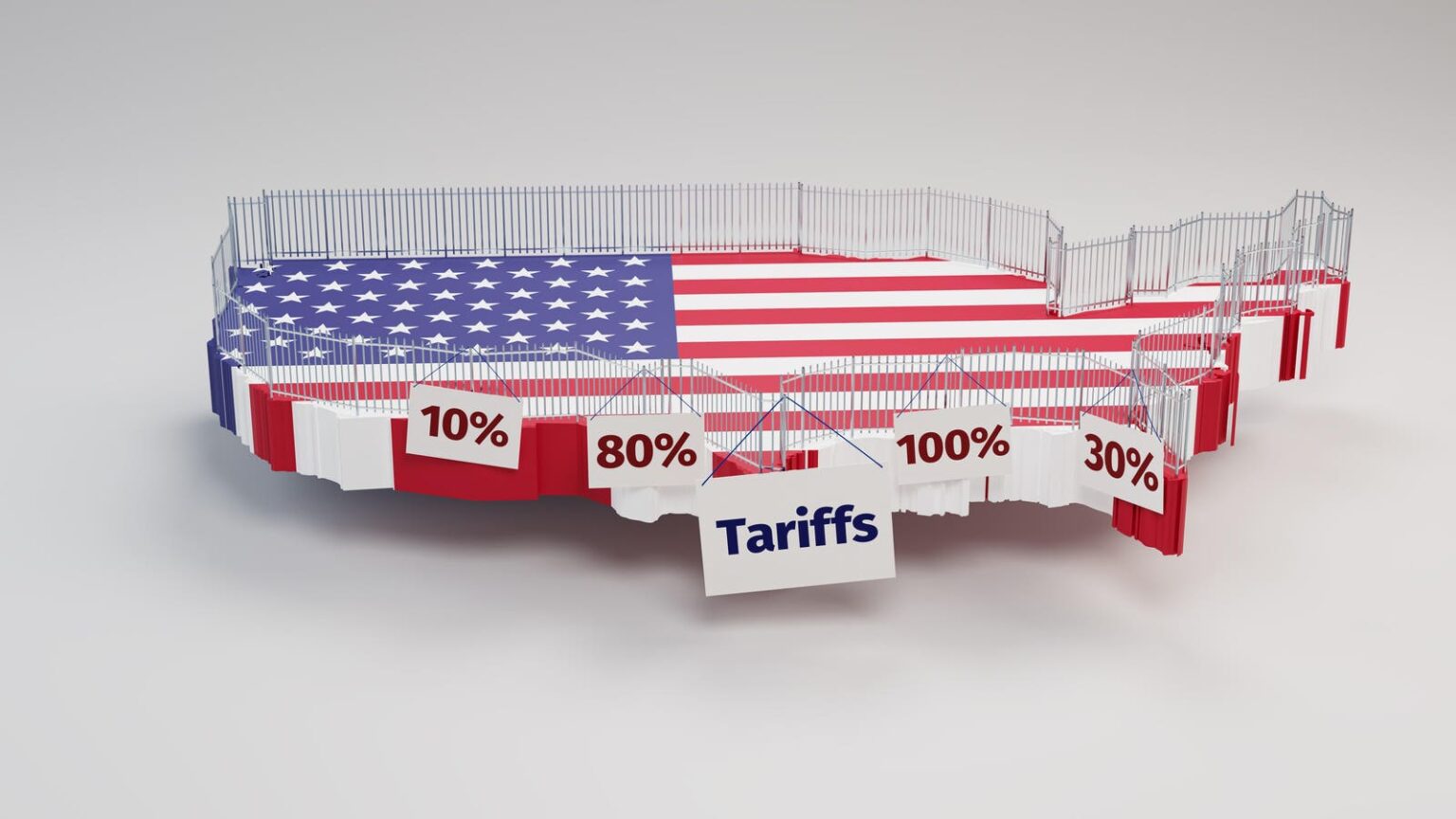

Tariffs are a tax imposed by one country on goods and services imported from another country. One purpose of tariffs is to protect domestic businesses from lower-priced foreign competition. This is a key reason why Shawn Fain, President of the U.A.W., voiced his support for Trump’s tariffs. If you’d like to know more, here’s an article I wrote on March 10 entitled, “UAW President Shawn Fain Supports Trump’s Tariffs. Here’s Why.”

Tariffs are sometimes called duties. If you’ve ever returned to America from a trip to Canada, you may have had the option to buy certain products “duty free.” In essence, this means no tax (tariffs).

How Do Tariffs Work?

Tariffs may be imposed on all imports from a specific country or on targeted items. In addition to protecting domestic businesses, tariffs can raise revenue for the importing country, helping to reduce a budget deficit. Tariffs may also cause a reduction in economic growth (GDP) as consumers no longer have the option to buy the previously lower-priced, foreign-made product. In response to a higher priced import, consumers may choose to reduce spending, which raises the risk of recession.

In today’s global economy, there is a downside risk with tariffs. Many U.S. companies are highly dependent on foreign-made components to make their products. When the U.S. imposes high tariffs on those components, it raises the cost of production, which increases the cost of the product. To keep production costs down, the U.S.-based company must find the required components from another source.

The U.S. company may be able to find what they need from within the U.S., but the cost is often higher than from its foreign supplier. Why? Primarily because the average annual wage in the U.S. in 2023 was about $65,470 per year, significantly higher than China’s $39,218 (USD) or Mexico’s $20,090 (USD). Since wages are one of the largest expenses for many companies, all else being equal, the higher the wage, the more expensive it is to manufacture. Even though the average wage can vary based on location, industry, etc., a higher average wage can be a good indication of the general standard of living for a given country. In short, the standard of living in the U.S. is much higher than in most foreign countries, making it more expensive to produce products.

If a domestic source is available for the components needed, buying from within the country can help boost GDP, assuming the materials needed for production are reasonably priced.

In addition to a financial strategy, tariffs can be used to facilitate foreign policy goals. For example, tariffs can be a tool to motivate foreign countries to reduce tariffs on U.S. products or services, which would help boost U.S. exports. Tariffs can also be used as leverage to get other concessions from a foreign country.

Who Pays the Bill?

Tariffs are collected at the U.S. border by the Customs and Border Protection agency. Tariffs imposed by the U.S. on imports are paid by the importing company. As mentioned, tariffs raise the cost of the products and services, which may be passed on to the consumer. At least one company, General Motors, recently announced that it would absorb the cost of tariffs on its imports to the tune of $4-5 billion. Thus, if a major U.S. company has a substantial profit margin and can afford to offset the cost of tariffs on its imports, their consumer would not face a price hike. However, small to medium sized businesses in America are not as financially able and will likely pass the increase to consumers. In short, there will likely be price increases on many products until new supply chains are up and running and/or tariffs are significantly reduced or eliminated.

A History of Tariffs and Trade in the U.S.

Tariffs have been a staple in the U.S. since its founding. In fact, until the modern income tax was installed in 1913 with the ratification of the sixteenth amendment, tariffs were the primary source of revenue for the federal government.

While trade is vitally important, it is not a major factor for the U.S. economy. It should be noted that the U.S. economy in 2023 – as measured by GDP, consisted of consumer spending (68%), business spending (18%), government spending (17%), and net exports (-3%). Thus, closing the trade deficit by boosting exports will have a positive effect on GDP.

The following chart shows the trade surplus or deficit for the past 78 years, on a quarterly basis, from January 1947 to January 2025. There were 313 calendar quarters during this period. The U.S. had a trade surplus in 31 of the quarters and a trade deficit in 282 quarterly periods. Thus, the U.S. had a trade deficit about 90% of the time. The chart also reveals that the deficits have worsened considerably in recent decades, which helps explain why tariffs have been front-and-center recently. Also shown is the largest trade surplus, which was $50 billion in the second quarter of 1980 and the largest deficit of $1.374 trillion during the fourth quarter of 2024.

Trade is an important part of the U.S. economy. After losing 90,000 manufacturing facilities and millions of jobs in the past 33 years, President Trump has decided to install substantial tariffs to increase domestic manufacturing and create more favorable trade deals between the U.S. and its trading partners. Will it work? Will inflation rise? How long will it last? How much pain will American consumers have to shoulder before the issue is resolved? Good questions, but questions that cannot be easily answered at this point.

Understanding tariffs and who pays is important. While the consumer will most likely pick up the tab, in some cases, the importing company will pay the tariff. If you’d like to learn more about tariffs, please read, “Trump’s Tariffs Loom. There’s More To It Than Most Understand” or “Trump’s Tariffs And Inflation – Who Pays?” or “Trump’s Tariffs: What Every American Should Know”

Read the full article here