In an era where cyber threats are evolving at an unprecedented pace, traditional security methods are struggling to keep up. Passwords alone are no longer sufficient, and even two-factor authentication (2FA) can be bypassed by sophisticated attackers. Enter Risk-Based Authentication (RBA)—a dynamic, intelligent approach to authentication that adapts to user behavior and risk levels in real time. As financial institutions, e-commerce platforms, and enterprises strive to balance security with user experience, RBA is quickly emerging as a crucial tool in the fight against cyber threats.

What is Risk-Based Authentication?

Risk-Based Authentication is an adaptive security framework that assesses the risk level of a login attempt or transaction based on multiple contextual factors. Instead of treating every authentication request equally, RBA dynamically adjusts security measures depending on the perceived threat level. This means that a routine login from a known device in a familiar location might require only a password, while an attempt from an unrecognized device in a foreign country could trigger additional authentication steps, such as biometric verification or one-time passcodes.

How RBA Works

RBA leverages a combination of data points and machine learning algorithms to determine the legitimacy of a login attempt. Some of the key factors evaluated in an RBA system include:

- User Behavior: Historical login patterns, such as the typical times and locations a user accesses their account.

- Device Recognition: Whether the login attempt is coming from a previously used or trusted device.

- Geolocation and IP Address: Identifying whether the access attempt is coming from a common or unusual location.

- Network Attributes: Evaluating whether the request originates from a public, private, or VPN-based network.

- Transaction Context: Assessing the nature of the action being performed, such as a high-value financial transaction versus a simple account login.

- Anomalous Activity Detection: Identifying rapid login attempts from multiple locations or other suspicious behaviors.

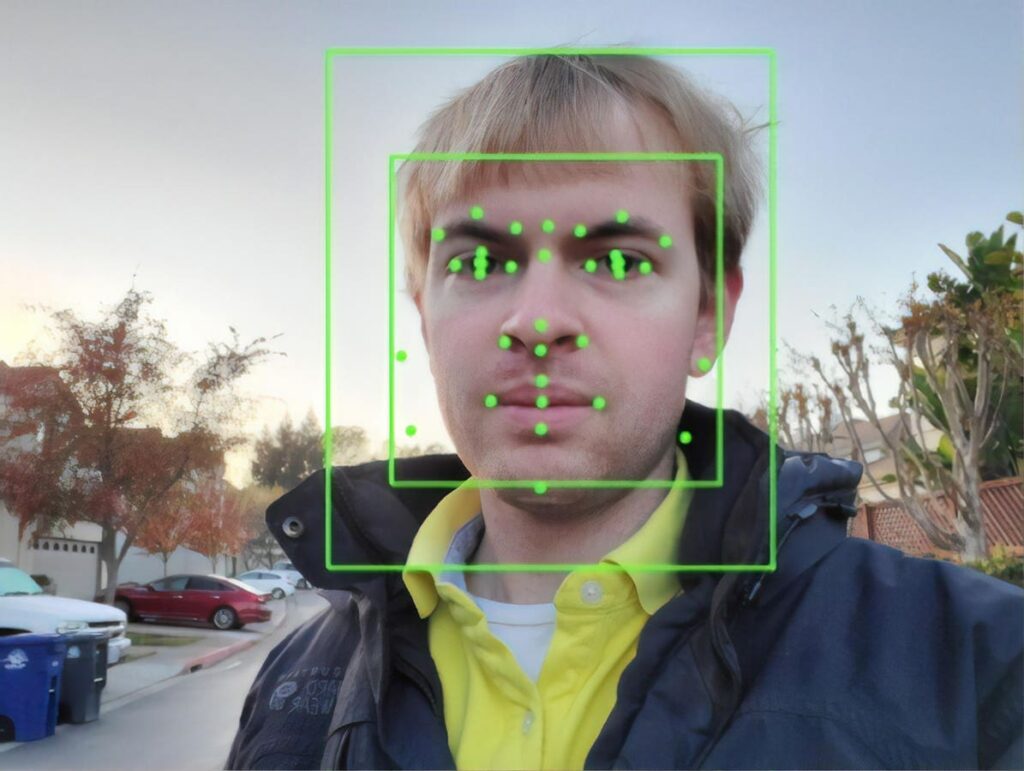

Based on these factors, the system assigns a risk score to each authentication attempt. If the risk score is low, the user may be granted seamless access. If the score is high, additional authentication measures—such as multi-factor authentication (MFA), biometric verification, or security questions—are triggered.

The Benefits of Risk-Based Authentication

1. Enhanced Security Without Compromising User Experience

One of the biggest challenges in cybersecurity is balancing robust protection with a frictionless user experience. RBA achieves this balance by applying stringent authentication measures only when necessary, reducing unnecessary disruptions for legitimate users while thwarting potential attackers.

2. Reduction in Account Takeovers and Fraud

Cybercriminals frequently exploit stolen credentials to gain unauthorized access to accounts. RBA minimizes this risk by detecting anomalies that may indicate credential stuffing, phishing attacks, or brute-force login attempts. Even if an attacker possesses a user’s password, unusual login behavior will trigger additional authentication steps, making unauthorized access significantly harder.

3. Adaptive and Future-Proof Security

Unlike static security measures, RBA continuously evolves by leveraging machine learning and artificial intelligence. These systems analyze vast amounts of data to refine risk assessments, ensuring that authentication measures stay ahead of emerging threats.

4. Cost Savings for Businesses

By reducing fraud, account takeovers, and customer support inquiries related to authentication issues, RBA helps organizations cut operational costs. Additionally, businesses can improve customer retention by providing a smoother authentication experience.

RBA in Action: Industry Use Cases

Many industries are already integrating RBA into their security frameworks to protect user accounts and sensitive data.

Financial Services

Banks and fintech companies are leading adopters of RBA. Given the high stakes of financial fraud, these institutions use RBA to detect suspicious login attempts and high-risk transactions, prompting additional verification when needed.

E-Commerce and Retail

Online retailers use RBA to prevent fraudulent transactions and account takeovers. If a purchase attempt is flagged as high risk, the user may be required to complete additional verification steps before the transaction is processed.

Enterprise Security

Businesses employing remote workforces utilize RBA to secure access to internal systems. Employees logging in from corporate networks may have a seamless experience, while access attempts from unusual locations trigger additional security measures.

Challenges and Considerations in Implementing RBA

While RBA offers substantial benefits, it is not without challenges. Businesses must address the following considerations to maximize its effectiveness:

- Data Privacy and Compliance: Organizations must ensure that RBA implementations comply with data protection regulations such as GDPR and CCPA. Transparency about data collection and user consent is essential.

- False Positives and User Friction: Poorly calibrated RBA systems may mistakenly flag legitimate users as threats, leading to unnecessary authentication steps and potential frustration.

- Integration with Existing Security Infrastructure: Deploying RBA requires integration with existing identity and access management (IAM) systems, which may require significant resources and expertise.

The Future of Risk-Based Authentication

As cyber threats continue to evolve, RBA is expected to play an increasingly prominent role in digital security strategies. Advancements in artificial intelligence and behavioral analytics will further refine risk assessments, making authentication even more seamless and precise. Additionally, the rise of passwordless authentication—leveraging biometrics and cryptographic security keys—may further enhance RBA’s capabilities by reducing reliance on traditional passwords.

Conclusion

Risk-Based Authentication represents a significant step forward in cybersecurity, offering a dynamic, intelligent approach to securing digital identities. By adapting authentication requirements based on real-time risk assessment, RBA enhances security while maintaining a seamless user experience. As businesses and consumers alike demand stronger protection against cyber threats, the adoption of RBA will only continue to grow. Organizations that embrace this technology today will be better positioned to safeguard their digital assets in an increasingly complex threat landscape.

For more on this, check out: 2FA Code Warning As Hackers Steal 17 Billion Cookies To Use In Attacks

Follow Holloman for insights on sustainable finance and technology

Read the full article here