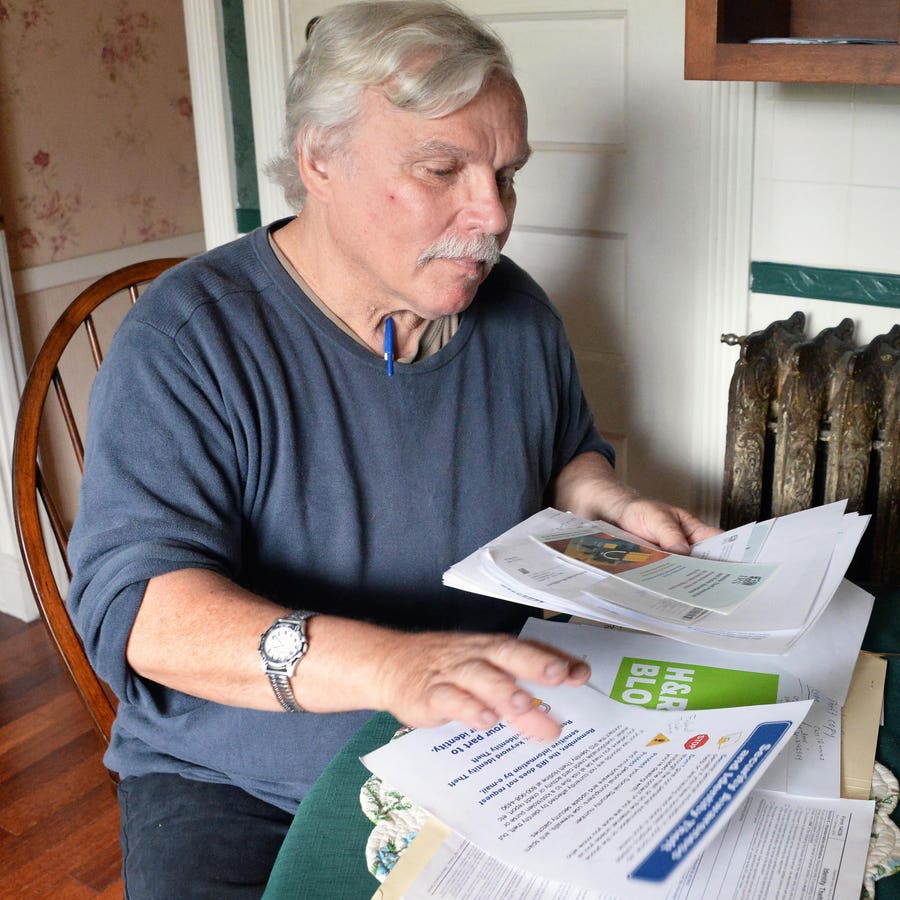

The year 2024 has just come to a close and many people may not yet be thinking about filing their 2024 income tax return, but perhaps they should. Income tax identity theft is a huge problem that costs the government billions of dollars annually, and also can delay your legitimate tax refund by as much as 675 days.

Income tax identity theft, by which identity thieves file phony income tax returns with easily created counterfeit W-2s using the Social Security number and name of their victim is still a major problem for the IRS although it is improving its enforcement actions. Recently Abraham Yusuff, the leader of a gang of income tax identity thieves that stole $30 million in fraudulent tax refunds from the IRS was sentenced to more than 14 years in prison. Six other members of the gang had already been convicted and sentenced.

Certain government forms require you to provide your Social Security number and if you are applying for a credit card or a loan, you will need to provide your Social Security number. However, many other companies and institutions with which you do business will ask for your Social Security number as an easy method of verifying your identity. The problem is that with a myriad of data breaches occurring every year, the privacy of your Social Security number is only as good as the cybersecurity of the companies that hold this information and overall, many of them do not do a good job of protecting their data. Years ago, Nancy Reagan coined the phrase, “Just say no” in an anti-drug campaign and it is a good idea to use those words when asked for your Social Security number by a company or institution that doesn’t need it. For instance, your physician doesn’t need it. The problem is that there is no law that prohibits these companies and institutions from asking for your Social Security number and they are allowed by law to refuse you their services if you fail to provide it.

Income tax identity theft is an easy crime to commit that doesn’t require extensive knowledge or sophistication. All it requires is that the identity thief have the name and Social Security number of their victim and the identity thief doesn’t even have to obtain this information directly from their victim The business model for many experienced cybercriminals is to gather large amounts of personal information through malware they use to create data breaches and then sell the stolen personal information on the Dark Web, that part of the Internet where criminals sell goods and services to other less technically sophisticated criminals to use for purposes such as income tax identity theft.

Once someone has stolen your Social Security number and filed an income tax return using your name, the problem becomes particularly personal. The IRS’s Taxpayer Advocate Service disclosed that victims of income tax identity theft wait an average of 675 days for the IRS to process their legitimate tax return and get their tax refund.

HOW CAN YOU PROTECT YOURSELF?

So, what can you do to protect yourself from income tax identity theft? First and foremost, you should file your return as soon as possible because if you file your income tax return before the identity thief does, you should be able to get your refund in a timely manner. However, income tax identity thieves are pretty prompt in filing their phony returns so you should also get a PIN from the IRS to use when filing your tax return.

The IRS started the Identity Theft Protection PIN program almost ten years ago, but it was only available to people who were already victims of identity theft and to people living in a few specific states chosen by the IRS to test the program.

In 2022, however, the IRS announced an expansion of its Identity Protection PIN Op-In Program that provides individual taxpayers with a six-digit code that is required to be included on the individual’s income tax return. This will protect someone whose Social Security number had been compromised from becoming a victim of identity theft because the identity thief will not know the six-digit code.

Here is a link to the section of the IRS’ website where you can apply for a PIN.

The PIN is only valid for a single year and must be applied for anew each year. Victims of income tax identity theft who have filed an identity theft affidavit with the IRS automatically receive a PIN by regular mail from the IRS.

Read the full article here